Solar Panels For Your Home Tax Credits

Solar panels for your home tax credits offer a significant opportunity to reduce the cost of going solar. This guide explores the intricacies of federal and state tax credit programs designed to incentivize residential solar panel installations. We’ll delve into eligibility requirements, calculation methods for potential savings, and the application process, empowering you to make informed decisions about harnessing clean energy for your home.

Understanding these tax credits is crucial for homeowners considering solar energy. By clarifying the various incentives available, we aim to illuminate the path towards more affordable and accessible solar power, highlighting the long-term financial benefits and environmental advantages. This comprehensive guide will equip you with the knowledge to navigate the process effectively and maximize your potential savings.

Home Solar Panel Tax Credits: A Comprehensive Guide: Solar Panels For Your Home Tax Credits

Source: sollunasolar.com

Installing solar panels on your home is a significant investment, but various federal and state tax credit programs can significantly reduce the upfront cost. This guide provides a detailed overview of these programs, helping you understand how to maximize your savings and navigate the application process.

Introduction to Home Solar Panel Tax Credits

Source: cloudfront.net

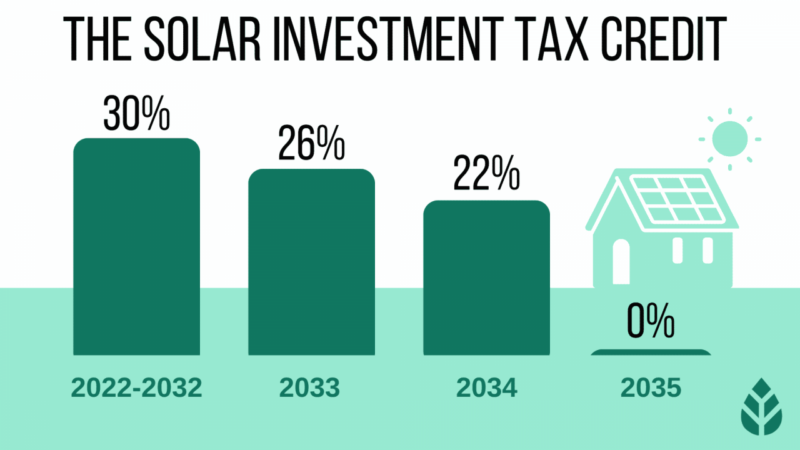

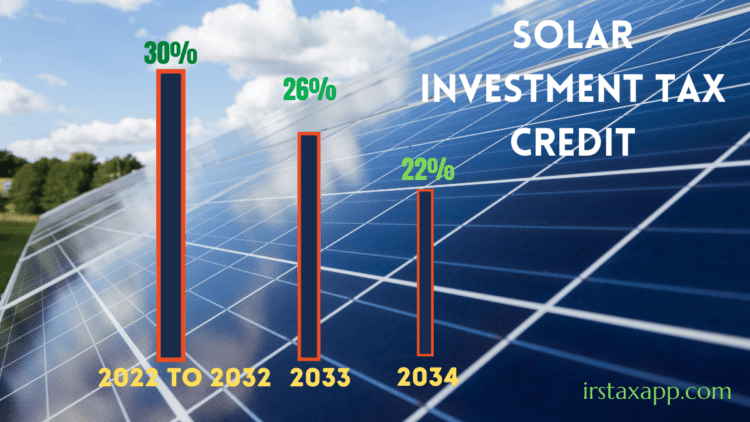

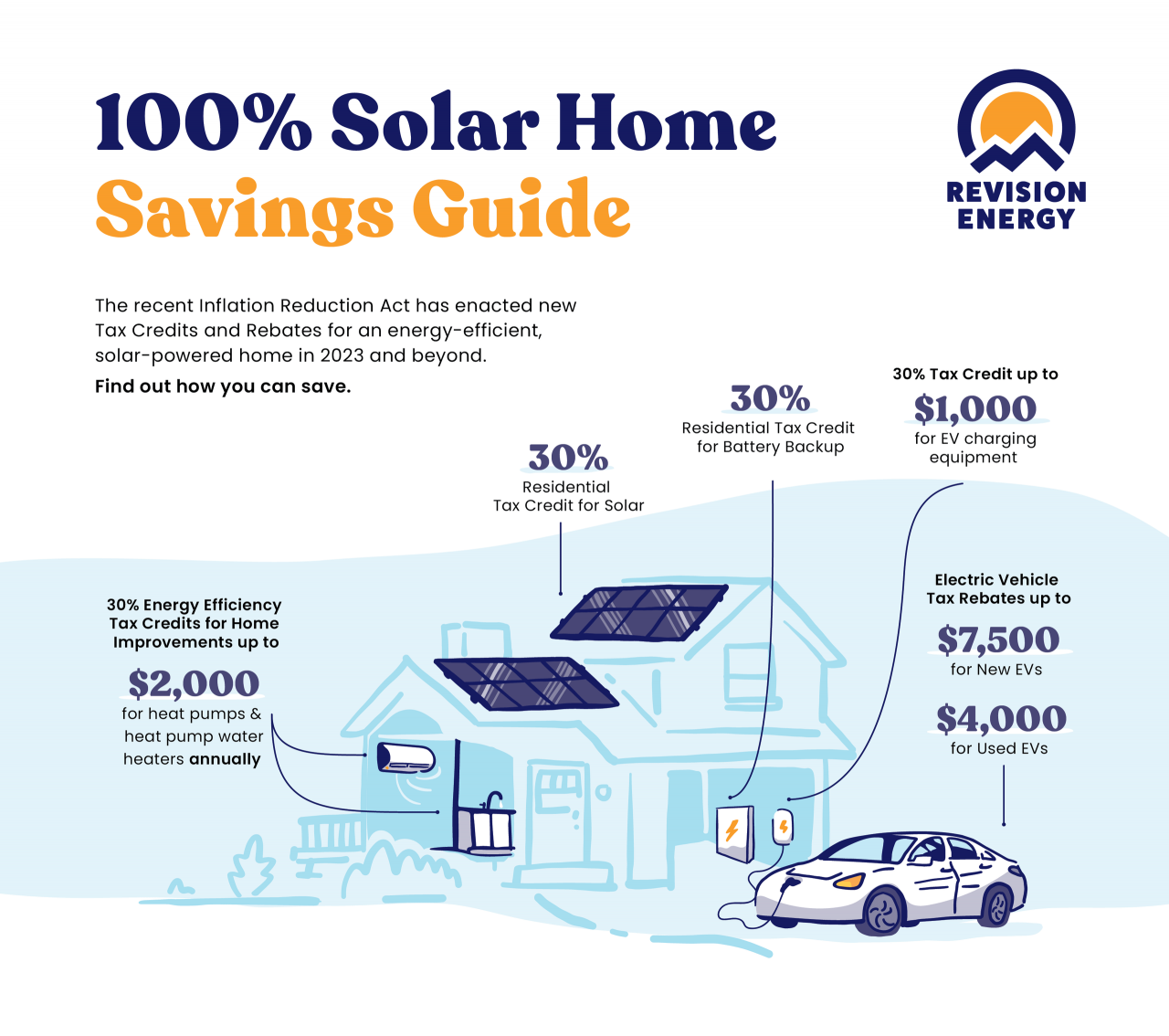

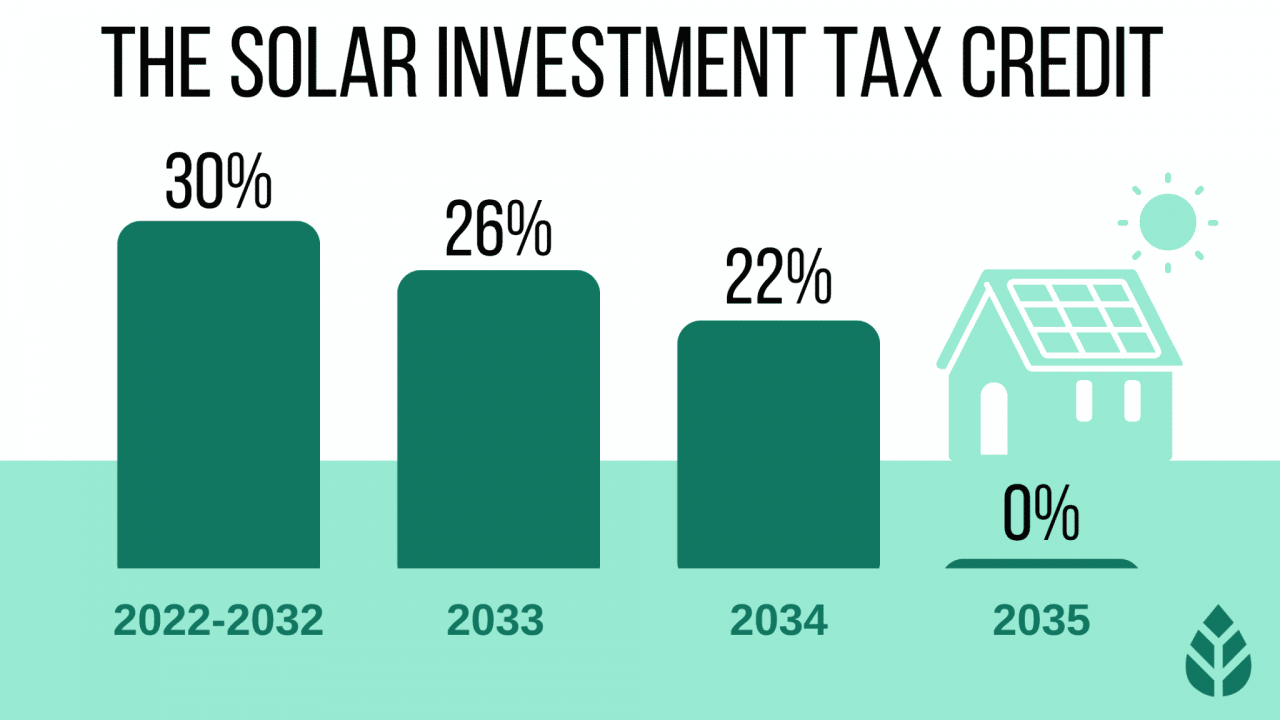

The federal government offers the Investment Tax Credit (ITC), a significant tax credit for homeowners who install solar energy systems. The ITC currently provides a 30% tax credit for residential solar installations. Many states also offer their tax credits, rebates, or other financial incentives, often complementing the federal ITC. These state programs vary widely in their specifics, including credit amounts, eligibility requirements, and application processes. Eligibility generally requires that the solar panels be installed on your primary residence and that you own the home. Specific requirements may differ depending on the state and the type of credit.

Calculating Potential Tax Savings

Source: irstaxapp.com

Calculating your potential tax savings involves considering the total cost of your solar panel system and the applicable tax credit percentages. Let’s illustrate with an example. Suppose a homeowner invests in a $20,000 solar panel system. With a 30% federal ITC, the tax credit would be $6,000 ($20,000 x 0.30). If the state offers an additional 10% rebate, that’s an extra $2,000 ($20,000 x 0.10), bringing the total savings to $8,000. The net cost after credits would be $12,000.

| System Cost | Federal ITC (30%) | State Rebate (10%) | Net Cost After Credits |

|---|---|---|---|

| $15,000 | $4,500 | $1,500 | $9,000 |

| $20,000 | $6,000 | $2,000 | $12,000 |

| $25,000 | $7,500 | $2,500 | $15,000 |

Impact of Tax Credits on Solar Panel Affordability, Solar panels for your home tax credits

Source: revisionenergy.com

Tax credits significantly increase the affordability of solar energy for homeowners. By reducing the initial investment, they make solar power a more viable option for a wider range of households. The long-term cost savings from reduced or eliminated electricity bills further enhance the economic benefits. Compared to traditional energy sources, solar power, with the help of tax credits, often presents a lower total cost of ownership over the system’s lifespan, especially considering rising electricity prices.

Navigating the Tax Credit Application Process

Source: turbifycdn.com

Claiming the federal ITC involves including Form 5695, Residential Energy Credits, with your annual tax return. You’ll need documentation from your solar installer, including details of the system’s cost and installation date. State tax credit applications vary, but typically require similar documentation. Deadlines align with the annual tax filing deadlines. For detailed instructions and forms, consult the IRS website (irs.gov) and your state’s energy agency website.

- Gather the necessary documentation from your solar installer.

- Complete Form 5695 accurately.

- File Form 5695 with your federal tax return by the applicable deadline.

- Check your state’s energy agency website for any additional state-level applications.

Illustrative Examples of Tax Credit Benefits

Let’s consider three homeowners: Homeowner A has a $15,000 system and receives a 30% federal ITC and a 5% state rebate, resulting in $5,250 in savings. Homeowner B, with a $25,000 system, benefits from a 30% federal ITC and a 10% state rebate, saving $10,000. Homeowner C, with a smaller $10,000 system and only the federal ITC, saves $3,000. These examples show how tax credits can substantially impact the overall cost, making solar power accessible to various income levels and system sizes.

State-Specific Tax Incentives for Solar Panels

Source: ecowatch.com

California, Nevada, and New York are among the states offering notable solar incentives. California often has net metering programs, allowing homeowners to sell excess solar energy back to the grid. Nevada offers rebates and tax credits, while New York provides various incentives, including property tax exemptions. To find your state’s specific programs, search “[Your State] solar incentives” online.

Long-Term Financial Implications of Solar Panel Investments

Solar panel investments offer long-term financial benefits. The reduction in electricity bills, combined with tax credits, significantly lowers the total cost of ownership compared to relying solely on traditional electricity. The ROI is enhanced by the tax credits, effectively accelerating the payback period. A solar panel system with tax credits will generally have a much lower total cost of ownership over its 20-25-year lifespan than a system without them.

Questions Often Asked

Can I claim tax credits if I lease my solar panels?

Generally, no. Tax credits are typically available only to homeowners who own their solar panel systems outright. Lease agreements usually prevent the homeowner from claiming these credits.

What happens if my tax liability is less than the credit amount?

Any excess credit amount may be carried forward to future tax years, allowing you to utilize the remaining credit in subsequent filings.

Are there income limits for claiming solar tax credits?

For the federal Investment Tax Credit, there are no income limits. However, some state programs may have specific income requirements, so check your state’s guidelines.

How long do solar panel tax credits last?

The specifics of the Investment Tax Credit (ITC) change over time. It’s crucial to check the current IRS guidelines as the percentage and availability may be subject to change or phase-out in future years.

Where can I find more information about state-specific incentives?

Your state’s energy agency website is the best resource for detailed information on state-level solar incentives and programs. The Database of State Incentives for Renewables & Efficiency (DSIRE) is also a valuable, comprehensive resource.

Comments are closed.